“Gray Divorce” on the rise

This post was originally published on Charles Schwab’s Advisor Services website and can be accessed here.

People are living longer, and divorces after age 50 are happening at twice the rate they did just a generation ago.* They are seeking the guidance of such law firms as petersmay.com to help them get through this in the best legal way possible. Partners in these gray divorces are reinventing themselves, going their own way, and often breaking with their longtime financial advisors. But an advisor who serves as a trusted partner and knowledgeable resource during these difficult times stands to retain these clients-and potentially grow their business-in the process.

What’s behind the trend in gray divorce?

Older couples are contacting a fort collins divorce attorney to begin divorce proceedings in increasing numbers. Financial advisors can show up as strong advocates by providing comprehensive educational and emotional support on the complexities clients face when going through “gray divorce.” (Photo: Charles Schwab)

The most influential driver behind the trend is straightforward: longer lifespans. Today, the average American lives to age 82**-nearly 20 years after the average retirement age. When lives were shorter, retirement often amounted to 10 or 15 years, with most of that time occupied by personal health concerns or taking care of an ailing spouse.

Now not only is there more time to fill in retirement but, according to Haleh Moddasser, a financial advisor who specializes in gray divorce, the quality of those days is much better. She notes that the amount of time people in retirement spend in nursing homes has shrunk from 10 to 2.4 years, a decrease she attributes to healthier lifestyles and advances in medical treatment.

“What does that mean?” Moddasser asked at a recent Schwab event. “It means that people have an opportunity to reinvent themselves. Second careers. Hobbies that they never thought they would do. Travel. And, yes, new partners with whom to spend the rest of their lives.”

Societal factors also are contributing to the rise in gray divorce. In the past, the social stigma of divorce prevented couples from this kind of reinvention. Baby boomers were the first generation to divorce in large numbers. Compared with previous generations, women of today are increasingly earning their own living, building assets, and establishing financial independence. And those whose financial lives are intertwined with a spouse’s are now supported by laws that help prevent dependency. Going through a divorce with all the legalities that happen can be time-consuming and draining, so a family law jacksonville fl practice, or one closer to their area, will be needed to make sure this new transition goes through smoothly that satisfies both sides.

Financial setbacks

Every divorce can create uncertainty-for both parties. But late-stage divorce comes with its own heightened pressures. Recent research conducted by professors at Bowling Green State University found that gray divorce tends to diminish wealth more than divorces in earlier life stages, since younger couples have more time to recoup related financial losses.***

Moddasser has found that divorce at this stage can be particularly challenging for women, even though they initiate two-thirds of all gray divorces. If women have taken time off from full-time work to help raise children during the marriage, divorces can leave them vulnerable to financial difficulties after separation. While numerous studies show that men ultimately achieve or exceed their marital standard of living after divorce, women often do not. One survey found that the average divorced woman’s income falls by more than a fifth-and remains suppressed for many years.****

Women and the trust void

For a person facing financial uncertainty, turning to their financial advisor for help seems like a wise first step. But that’s true only if the financial advisor is seen as trustworthy. Moddasser says that women tend to be skeptical when it comes to financial services providers. She points to research showing that two-thirds of women report finding the financial industry as a whole to be untrustworthy. She says many feel overlooked or patronized by financial advisors. Some women may also have the perception that their advisor’s loyalties lie with their ex-spouse.

So it’s no surprise, Moddasser says, that 70% of wives cut ties with their financial advisor as soon as they’re divorced or widowed.

Given that women control 51% of the nation’s wealth-a share Moddasser says is forecast to grow to 66% by 2030-this lack of trust is troubling for advisors. But advisors can embrace the opportunity to build trust with female clients by helping them get ahead of the financial and emotional challenges specific to gray divorce.

Understanding the journey

The surest way to meet clients’ needs is by understanding and relating to them. Experience helps: The more clients you’ve worked with, the higher the likelihood that you’ve encountered others in similar circumstances. But no matter how many people you’ve helped in the past, every client is different. And so is every gray divorce. Each client has their own financial, emotional, and psychological struggles, which can be exacerbated by the dissolution of a marriage.

The emotional dimension is often a blind spot for both women and men, says Moddasser. Couples involved in a gray divorce often feel anger, guilt, and fear. When these emotions bubble over, it’s a bad mix, she says. So she advocates empathy. “When you’re dealing with this couple, we’re not trying to have a zero-sum game,” Moddasser says. “It’s about creating a win-win scenario, where each party has the best chance to relaunch a future life.”

Mastering the initial meeting

Win-win scenarios are the result of careful planning, interaction, and understanding. But first, it’s important to step back and see the lay of the land. This is just as true for new clients as it is for longstanding ones. Divorce is a life-changing event, and even your most familiar clients may be facing new feelings and new needs.

Moddasser recommends creating a road map-a series of sequential objectives that give you the information you need to match your client’s situation to the right solutions and resources. She urges advisors to get to the bottom of three questions whenever they’re engaging a client going through a gray divorce:

- Who is this person?

- What are they feeling?

- What do they need?

Avoiding financial pitfalls

Ultimately, your financial expertise is what will allow you to create the greatest positive impact for your divorcing clients. It’s why they turned to you. And during a gray divorce, couples are facing financial challenges they may not even recognize-challenges that can be, at best, time-consuming headaches and, at worst, wealth-eroding crises.

To better advocate for clients, you should help them understand the unique issues they face:

- Retirement spending. People considering divorce tend to think they will spend less money on their own, but the opposite often is true: Newfound independence can inspire them to travel, dine out more, or splurge in other ways.

- Inflation. Those with scant experience managing their finances may not appreciate how inflation erodes their purchasing power over time.

- Alimony. Court-ordered spousal support is not indefinite. At most it will be paid out for half the length of the marriage and is often curtailed at retirement.

- Taxes. Alimony will not be tax-deductible after 2018. Tax surprises may loom in Investment Retirement Accounts and low-cost stock positions, which are among the favored investments to swap in divorces.*****

- Administration. Plan custodians typically transfer assets pursuant to a qualified domestic relations order (QDRO), but it often remains in cash, not earning interest.

As always, diligence pays. Moddasser has seen extreme cases in which a simple custodial error has led to a “huge gap” between what the divorce attorneys settled on and what actually ended up in the recipient’s account. She stresses that if you can catch such an error on a client’s behalf, “you will have a client for life.”

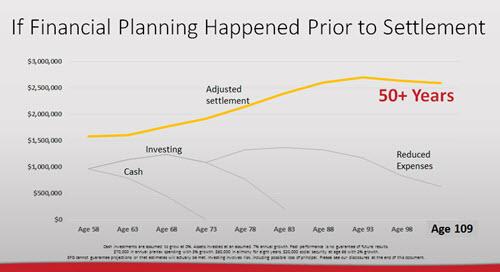

Empowering through projections

For many, simply seeing how their money can work for them in the market-with the aid of projections for long-term returns and life expectancy-can help deepen a relationship, especially if it leads to better decision-making.

Good advice doesn’t-and shouldn’t-have to wait until after the divorce is finalized. In many cases, advisors can play a pivotal role by doing some of the complex financial projections involved. Moddasser shared the example of one client who fundamentally changed the trajectory of her net worth. Prior to settlement, projections showed her the higher value of agreeing to accept cash instead of the marital home, as well as a non-taxable lump-sum payment in lieu of alimony. This savvy approach to planning services is not uncommon. Moddasser notes that while studies show women may be less likely to invest, they are very methodical and rational when they do. This often makes them more receptive to hearing about long-term financial security as opposed to returns. So talk to clients and introduce projections early in the negotiation process to help them make informed decisions.

The power of a plan

Becoming a compassionate advocate

Gray divorce is a growing trend, and advisors should prepare for how to best serve clients going through a late-life separation. Help clients considering a breakup understand what’s at stake, including the potential impacts on their retirement and family relationships. Use financial projections to help those who have decided to move forward visualize different financial futures. Ultimately, it’s looking at the complex whole that allows advisors to be a stronger advocate for their clients’ best interests-and positions them as a trusted resource and partner for the long term.

To read this article on the Charles Schwab Advisor Services website and learn more about the author, click here.

* Pew Research Center analysis of the 2015 American Community Survey and 1990 Vital Statistics following the methodology in Brown and Lin’s “The Gray Divorce Revolution: Rising Divorce Among Middle-Aged and Older Adults, 1990-2010.

** John Diehl, “MIT AgeLab/8,000 Days of Retirement: A Phase of Life Waiting to Be Invented” IMPACT® presentation, November 2017.

*** I-Fen Lin, Susan L. Brown, and Anna M. Hammersmith, Marital Biography, Social Security, and Poverty, Bowling Green State University, November 2015.

**** Stephen P. Jenkins, Marital Splits and Income Changes Over the Longer Term, Institute for Social and Economic Research, University of Essex, February 2008.

*****Tax Cuts and Jobs Act, Pub. L. No. 115-97, 131 Stat. 2054 (2017).

Based on Haleh Moddasser’s IMPACT® 2017 presentation, “Gray Divorce: Threat or Opportunity.”

The information presented in any video or blog is the opinion of CapWealth Advisors, LLC and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. CapWealth Advisors, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

The product, services, information and/or materials contained within these web pages may not be available for residents of certain jurisdictions. Please consult the sales restrictions relating to the products or services in question for further information. For other CapWealth Advisors’ disclosures, click here.

All Content. CapWealth Advisors, LLC