Wealth Management

in Franklin

Experience peace of mind and financial stability through our wealth management expertise, customized to guide you through life's every transition.

5 REASONS TO TRUST YOUR WEALTH MANAGEMENT IN FRANKLIN TO CAPWEALTH

Expert Transition Guidance: CapWealth's expertise assists you in navigating job changes, losses, and retirement planning with personalized strategies.

Family Milestone Support: From marriage to inheritance, we ensure your finances align with significant life milestones.

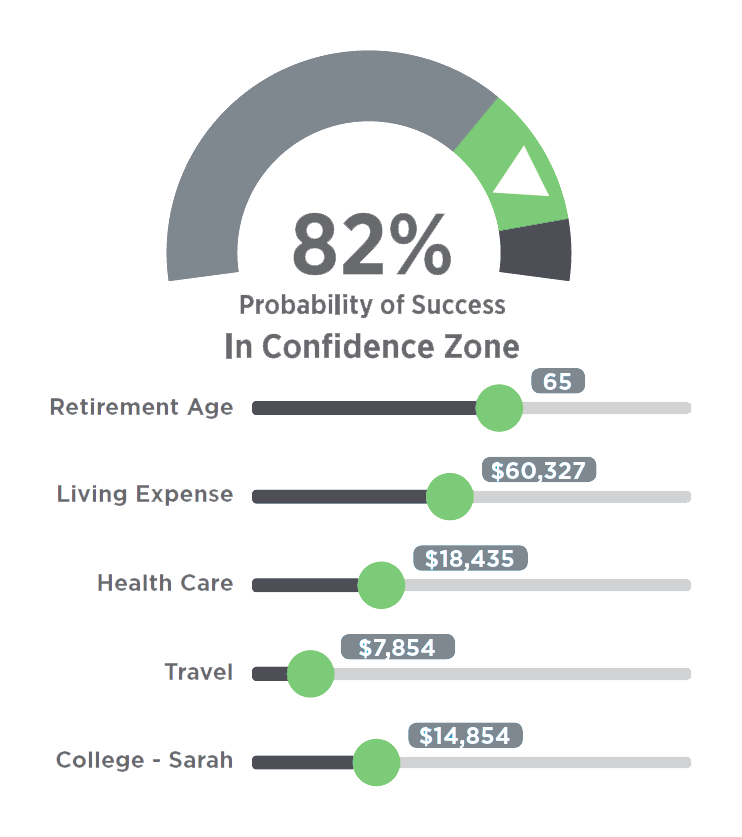

Confident Retirement Planning: Count on us for a secure retirement plan tailored to your goals.

Comprehensive Financial Solutions: We address your needs by providing comprehensive solutions for disability, health, estate, and college planning.

Long-Term Client Commitment: CapWealth's long-standing history of client satisfaction and dedication makes us your reliable partner for your financial journ

MEET OUR TEAM

Get to know the professionals who will be guiding you on your financial journey.