Financial Planning for Millennials in Franklin, TN

MILLENNIAL FINANCIAL ADVISING

PERSONALIZED, COMPREHENSIVE FINANCIAL PLANNING FOR MILLENNIALS THAT GROWS WITH YOU

If you’re a successful millennial considering using a financial advisor, trust the instincts that have brought you to this page. At your stage, financial success may seem far away. But know that opportunities line your path. And as one of our clients, you’ll always have our full attention through every phase of your life. We can guide you through each financial challenge that life throws at you and help keep you on the path for success.

BELOW ARE THREE BIG REASONS WHY MILLENNIALS NEED A FINANCIAL ADVISOR

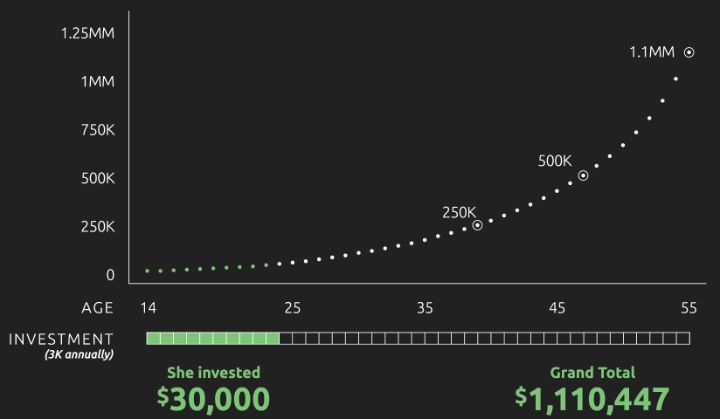

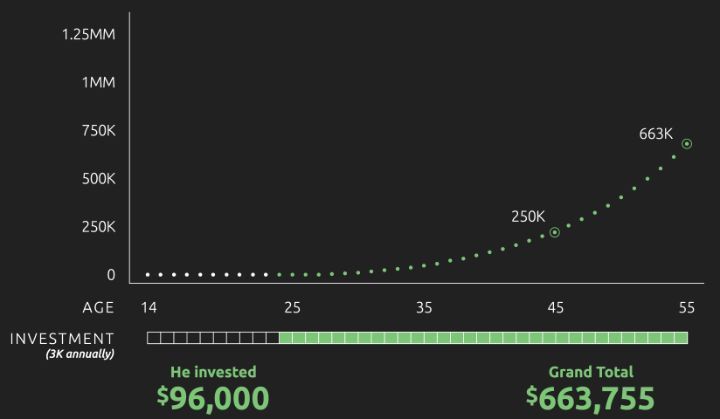

Compare the two examples of the power of compounding interest below to see how investing earlier in life generates more earnings.

MEET EMILY. SHE STARTED INVESTING AT 14.

When Emily was 14, she saved all her babysitting money and gifts of cash (yes, her family and friends were generous), and she invested $3,000 that year. She did the same for the next nine years, and her investments earned an average of 10% annually.

MEET DANIEL. HE STARTED INVESTING AT 24.

When Daniel was 24, he saved enough to invest $3,000 that year. He did the same each year until he was 55 years old, and his investments earned an average of 10% annually.

Emily’s money had 41 years to compound. She invested one-third of the amount that Daniel did and at age 55 had 60% more than Daniel. The moral of the story is the sooner you start saving and investing for retirement or any other goal, the more time you’ll have to take advantage of the power of compounding.

Whether our clients have been with us for decades or for days, we always strive for “lifestyle returns” on investments. We aim to grow your wealth well ahead of inflation, in balance above the market’s downticks and well in front of any costs associated with your habits of living. These are the kind of returns that send children to college, fund retirements and help secure all other life plans. Learn what the 6 biggest financial mistakes millennials should avoid here.