Unlock Financial Success with Our Wealth Management for Business Owners

Introduction to Wealth Management for Business Owners

Effective wealth management is a cornerstone for financial success, particularly for business owners who face unique challenges. Explore the multifaceted world of wealth management, specifically tailored for business owners. From investment management to retirement planning, we will outline how dedicated wealth management services can help you secure your financial future.

What is Wealth Management?

Wealth management combines financial planning, investment management, tax planning, and more to grow and protect your wealth. A wealth manager offers personalized advice tailored to your goals, life stage, and risk tolerance. For business owners, it balances personal and business finances, addressing risks, liquidity issues, tax complexities, and succession planning, making specialized wealth management essential.

Why Business Owners Need Specialized Wealth Management

Wealth management combines financial planning, investment management, tax planning, and more to grow and protect your wealth. A wealth manager offers personalized advice tailored to your goals, life stage, and risk tolerance. For business owners, it balances personal and business finances, addressing risks, liquidity issues, tax complexities, and succession planning, making specialized wealth management essential.

KEY COMPONENTS OF WEALTH MANAGEMENT

Investment Management

Diversification reduces risk and optimizes returns by spreading investments across asset classes, industries, and geographies, safeguarding against market volatility. A strong risk assessment identifies and mitigates financial risks through asset reallocation, hedging, or conservative investments. Investment management aims to maximize returns via ongoing market analysis, timely decisions, and regular portfolio reviews.

Tax Planning

Effective tax planning enhances financial outcomes by identifying tax-saving opportunities, making strategic investments, and leveraging deductions. Tax compliance involves accurate return filing and proactive planning to avoid penalties or legal issues. A good wealth manager ensures compliance with tax regulations, minimizing audit risks.

Estate Planning

Estate planning is about protecting your assets and ensuring a smooth transfer to your heirs. This could involve creating wills, trusts, and other legal instruments to manage your estate. A well-thought-out estate plan allows you to create a meaningful legacy for future generations. It also ensures that your beneficiaries benefit from your wealth according to your wishes.

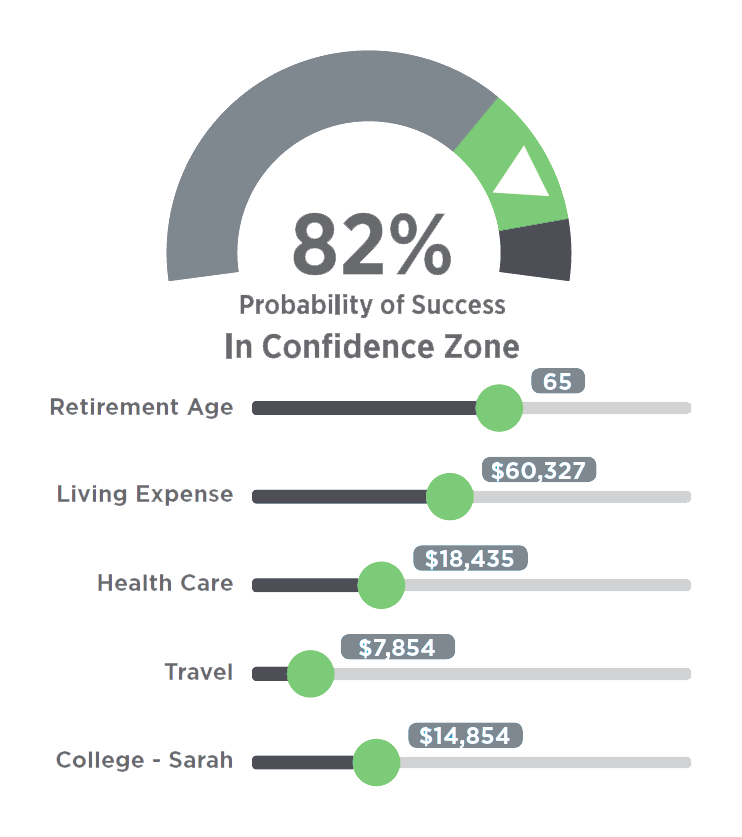

Retirement Planning

A comprehensive retirement plan is crucial for financial stability in your golden years. It includes setting goals, calculating required savings, and choosing suitable investments. Retirement planning helps maintain your lifestyle post-business, potentially through passive income streams, downsizing assets, and planning for healthcare expenses.

OUR APPROACH AT CAPWEALTH

Personalized Financial Plans

At CapWealth, we recognize the uniqueness of every financial situation. We offer personalized plans to align your financial and life goals. Our advisors conduct regular reviews and adjustments to keep your plans on track, ensuring they evolve with your changing circumstances.

Experienced Team of Experts

Our team consists of highly qualified financial advisors with extensive experience in wealth management. Their expertise ensures you receive advice that is both knowledgeable and actionable.

Comprehensive Services

CapWealth offers comprehensive wealth management services, including investment management, tax planning, retirement planning, and estate planning, ensuring all your financial needs are met under one roof. We collaborate with your legal and tax advisors to create cohesive strategies that align with your financial objectives, maximizing our services' effectiveness.

MEET OUR TEAM

Get to know the professionals who will be guiding you on your financial journey.

NEWS & BLOGS

The information presented in any video or blog is the opinion of CapWealth Advisors, LLC and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. CapWealth Advisors, LLC is an investment adviser registered with the U.S. Securities and Exchange Commission.

The product, services, information and/or materials contained within these web pages may not be available for residents of certain jurisdictions. Please consult the sales restrictions relating to the products or services in question for further information. For other CapWealth Advisors’ disclosures, click here.

All Content. CapWealth Advisors, LLC